WBC Partners Position Overview

Partners Portfolio Overview

2024 was a forgettable year for White Brook Capital’s middle capitalization focused fund. Our fortunes have reversed so far in 2025 as several of our portfolio companies have preannounced 4th quarter results and given constructive 2025 guidance. We’ve had a good first 3 weeks of 2025 and are looking forward to a much better year.

The dominant theme across the portfolio is that it owns good companies in industries that for one reason or another are out of favor. Clearly, in many cases I had expected an inflection in 2024 but confused Biden administration policy, macroeconomic pressure, or a lack of execution delayed the turn until 2025. Moving forward, we’ll be quicker to pull the plug on investments that do not perform and revisit.

Brazil

We have two companies with significant operations in Brazil, a country whose currency devalued by over 25% in 2024 compared to the US Dollar. Simply, Brazil has a balanced budget provision and an export based economy during a time when global growth slowed, and President Lula De Silva increased spending on social programs to address the effects of Brazil’s wide socioeconomic disparities. As of the final days of 2024, the Brazilian government passed fiscal measures reducing spending and although they were less aggressive than expected, currency pressures have abated.

Afya Limited (AFYA) had a difficult 2024 and is flat so far this year. With a business wholly denominated in Brazilian Reais and a stock price in dollars, the stock suffered even while Afya's exceptionally stable business executed exceptionally well. Their medical seat fill rates continue to be 100% in the base medical education business, the number of seats continue to grow, and pricing is ahead of inflation, even while the number of applicants per seat is near all time highs. Their speciality education and B2P business units also continue to grow quickly and with improving margins. With ~10% revenue growth and 20%+ EPS/FCF growth, at ~10x next year’s earnings estimate, 7x EBITDA, and a double digit free cash flow yield, the stock is simply cheap. If the country’s currency is stable or improves versus the dollar, I continue to believe we will make very significant returns moving forward.

The Mosaic Company (MOS) had a tough 2024 as well, but is strong so far in 2025. Mosaic sells two commodities globally and has a retail distribution network in Brazil. Of the two commodities, Phosphate is historically strong and looks to at least hold that strength in 2025 with demand far exceeding supply and new use cases in high capacity batteries taking increasing amounts of phosphate out of the fertilizer supply base. Potash on the other hand is well supplied and subject to international politics. In typical Biden administration policy weirdness - Belarus, Russia, and Canada are the largest exporters of potash globally - as a result of Belarus’ support of Russia in the Ukraine War, Belarus’ potash is sanctioned by the United States. Russian potash isn’t, and it has flooded the United States and the world as Russia seeks to pay for its war. Adding a wrinkle, Canadian potash, which supplies much of the United States’ needs, but competes at the next lowest price, in this case Russian potash - is likely to be tariffed by the Trump administration. Even more interestingly, Mosaic, is a Florida headquartered company with the largest US Phosphate mine, but it supplies potash out of Canada. We will see how the next few months affect Mosaic, it could be beneficial.

The Company’s Brazilian distribution arm’s contribution to the consolidated company suffered from the poor foreign exchange rate of BRL to USD, but continues to grow its market share.

While this investment is long in the tooth for White Brook, the stock is extremely cheap, produces very significant free cash flow, has a healthy balance sheet and now that the new CEO is almost a year in his new role, I expect value creation for the equity to be imminent or for the position to exit the portfolio.

Food

Portillo’s Inc. (PTLO) is up over 20% so far this year. On January 14th, the Company preliminarily announced same store sales growth and gave supportive guidance for 2025 driving much of that stock improvement. But the even more important news should have been picked up during 2024, and was simply overlooked. During the third quarter, they announced they would explore financing the building for their new stores, rather than leasing the ground, but financing the building themselves. The move meant that the company can grow more quickly while also allowing for free cash flow after growth investments to begin to flow to the bottom line. This is exactly the scenario outlined in my bull case write up last year. We were obviously too early in establishing our position in 2024, but this is the setup that we outlined in our thesis, and one that, as they execute, should prove lucrative.

Krispy Kreme, Inc (DNUT) has languished since our entry in 2024. In the fourth calendar quarter, the Company reported earnings inline with expectations while also doubling their forecast for the number of McDonald’s locations they would be in by the end of the year. Importantly, given the timing of the rollout during the third quarter, they weren’t yet seeing a financial impact of distributing through McDonalds.

Unfortunately, during the fourth quarter, the Company was the victim of a cyber attack that disabled its online ordering capability. While it has been rectified, one of the ways that investors try to determine a company’s financial results before quarter end, is by buying aggregated credit card data from data brokers. With their incremental growth coming from selling in McDonalds and online ordering down for a significant period during the fourth quarter, the credit card data looks bad. We think results will turn out better when they report. Early reviews of the Krispy Kreme McDonalds experience are very good and McDonald's workers report customer enthusiasm for Krispy Kreme that portends solid results for the partnership. Although many of these locations weren’t launched until late in the fourth quarter, I believe fourth quarter results should largely be glossed over, with a focus on donut velocity at McDonald's and the positive momentum seen there. Furthermore, by the second quarter, it should be clearer what Krispy Kreme’s post McDonald’s rollout form will look like and the stock should begin to respond.

Housing

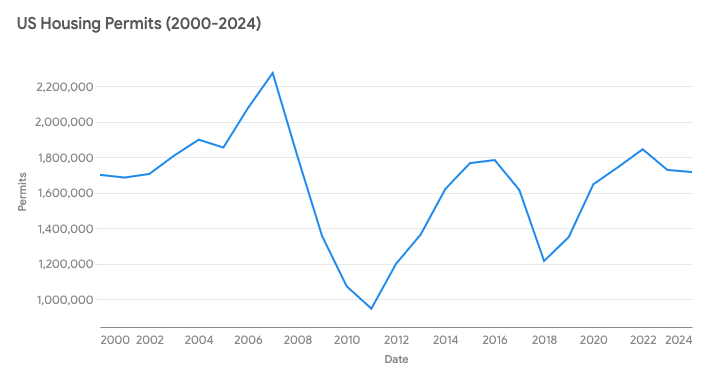

We have two investments taking share in a stagnant US housing market, but are poised to accelerate FCF growth if and when the industry’s recovery continues.

Builders FirstSource, Inc (BLDR) is up 2.5x since we bought the stock, but languished in 2024 on the back of higher interest rates. It is up ~15% so far this year. Their homebuilder customers argue that consumers need 30 year mortgage rates of 6.75% and below to be enthusiastic home purchasers and while that was achieved during 2024, it was true for only a short time. During this trough level of activity Builders FirstSource was able to generate over $1.2 billion in cash flow and believes the same is likely in 2025. Big picture, the nation remains underhoused, their homebuilder customers have begun shifting new builds to smaller homes, which use less homebuilding supplies, but should get volume moving again, and Builders FirstSource is a necessary part of the value chain when building and renovating homes. The increased prevalence of natural disasters is also an unmitigated positive for Builders which supplies the reconstruction activity. Potentially higher lumber prices due to tariffs on Canadian imports is also a positive, as Builders earns a margin on total transaction value. The Company continues to buy back stock and while the upside may not be as explosive in the near term as it was in 2023, we continue to believe it’s a solid core holding with embedded options to achieve significant upside in 2025 and beyond.

Wayfair, Inc (W) has been flat since we bought the stock in 2024 and so far this year. Critically Wayfair is only a marketplace. While there appeared to be some confusion in 2024, the company does not manufacture or retail furniture (outside of the 1 brick and mortar location in Wilmette, IL). The inventory it carries is owned by its suppliers or is forward placed in its fulfillment centers, not by Wayfair itself. Wayfair is sensitive to consumer confidence, retail spending, new home formation, and home sales, however, with significant weighting towards the latter. The “move” rate was relatively low in 2024, and while Wayfair grew by taking market share, the overall environment was depressed. The Company has consistently improved margins is generating free cash flow and investing in loyalty programs to encourage repeat business for sellers and buyers while simultaneously further developing the site’s advertising business similar to Amazon’s recent initiatives. When the industry finally turns, Wayfair should be a significant beneficiary.

Financing & Hard Cash Flowing Assets at Industry Bottoms

The Greenbrier Companies, Inc (GBX) stock performed well over 2024, and the company reported their fiscal first quarter in early January. They continue to execute and the market is taking notice. The railcar industry is operating at a low-volume replacement steady state but even in this environment, the Company is producing free cash flow - unlike in previous railcar cycles - while also building its highly used leasing fleet. Should there be a railcar market upturn driven by greater manufacturing activity in the United States, Greenbriar has capacity available to earn at high incremental margins. With a 50%+ return since we entered, we have taken off some exposure, but continue to regard Greenbriar as a solid position.

Openlane, Inc (KAR) had a solid 2024. Similar to Greenbriar the company has executed well, increasing gross margins at low volumes, while operating in an industry trough. 2025 should see vehicle volumes continue the late 2024 uptrend and there’s no reason to believe that the market share gains experienced in 2024 shouldn’t continue. Also during late 2024, the Company held an investor day that highlighted the Company’s financing business. It appears the Company believes, as I do, that either its digital wholesale used car auction business is severely undervalued or its leading secured lending financing business is. At the investor day, the Company changed and added to its disclosure in order to help the market recognize the value of the asset. Despite protestations, I believe that should the Company not achieve better recognition of this business, management would be willing to separate and sell it in part or whole. If it gets the “right” valuation for the division, the stock is severely undervalued at the current price.

Disappointment

Green Plains Inc (GPRE) - Green Plains was a disaster in 2024. We wrote about Green Plains travails during 2024 and activities since the last update don’t warrant another. In the end, the Biden administration was not a positive one for Ethanol producers between dragging their feet around establishing standards, not enforcing the laws on the books, and struggling to complete their mandated rule making within the same 365 days as the deadline or the date before the new standards were supposed to be implemented. Their preference for electric automobiles seemingly subsumed all other energy priorities, and ignored the world’s current condition. In the end, the Greet Model’s prescriptions which in their preliminary form betrayed ethanol producers and their expectations, came in as they should have; the Blenders Tax Credit which benefitted Chinese and Brazilian used oil salesmen gave way to the producers tax credit that benefits US farmers and ethanol producers; and the Inflation Reduction Act’s biofuel provisions are now being signalled as likely to be kept by the new administration along with a new push for 15% nationwide ethanol blend approval (delayed in the 8 states that applied for it until 2025 under Biden). In short, the turn in administration is a positive one for Ethanol and for Green Plains and the inflection in EBITDA and cash flow are on schedule for 2025. Additionally, Ancora Advisors remains as an activist investor in the Company, and we expect movement in the near term.

Best of the Best bought Cheap

Life Time Group Holdings, Inc (LTH) had a terrific 2024 as the Company became free cash flow positive and operated at a high level, opening new locations and achieving very healthy margins. Here in January, the Company preannounced fourth quarter 2024 results and introduced better than expected 2025 guidance. The stock continues to outperform. Interestingly, in this fourth quarter, the Company achieved its long term leverage ratios ahead of schedule. Given the 25% EBITDA growth expected for 2025 and the capital lightness of its newer ventures, it’s likely there will be a stock buyback or a dividend announced early this year. Lifetime is no longer cheap, but it’s an almost perfect company that is well managed and has a solid future.

Technology

Box, Inc (BOX) had a solid 2024 and overcame a significant headwind from the depreciating Japanese yen that affected a third of the business. On a reported basis the company’s financial metrics appear flat, but controlling for currency, net revenue retention rate, billings, and remaining performance obligations all began to reaccelerate by the end of the calendar year. These are signs of inflecting revenue growth in 2025 and beyond.

Moving forward, AI should enable the Company to do more for its customers and allow them to quickly develop AI agents. From 2016-2021, the market rewarded SaaS applications that helped their customers manipulate and use data, but didn’t much care how and where that data was stored. Artificial intelligence cares deeply about the silos data may be in, and doesn't like it. Box provides a highly accessible data layer for the data humans generate and use, allows a wide variety of AIs to access that data, automates document creation, and provides a tool to develop workflows around it all. I believe their AI agnostic vision will lead to further churn decline and accelerate customer acquisition leading to stock outperformance.

Okta, Inc (OKTA) was basically unchanged from where we bought it in 2024, although its had a good start to 2025. Okta’s products are used by customers and consumers to manage and secure identities. I believe we acquired shares at an attractive price and look forward to publishing a write up early this year.

Small Cap Healthcare

Rapid Micro Biosystems, Inc (RPID) was entered in early 2025. Given its small size and the focus on middle capitalization stocks in the portfolio, the Company will be a very small position in the Fund. In early January the Company preannounced fourth quarter 2024 results and announced a collaboration with a large software partner that should help the Company’s sales efforts. The stock is up over 25% this year.

InfuSystem Holdings, Inc (INFU) was also entered in early 2025, is a small cap and therefore will be a very small position in the Fund. A write up on Infusystems is also expected to be shared early in 2025.

As always, feel free to reach out to discuss this or any of your investments at White Brook Capital. I thank you for your support and will strive to continue to earn your trust.

Sincerely,

Basil F. Alsikafi

Portfolio Manager

White Brook Capital, LLC

All investments involve risk, including loss of principal. This document provides information not intended to meet objectives or suitability requirements of any specific individual. This information is provided for educational or discussion purposes only and should not be considered investment advice or a solicitation to buy or sell securities. The information contained herein has been drawn from sources which we believe to be reliable; however, its accuracy or completeness is not guaranteed. This report is not to be construed as an offer, solicitation or recommendation to buy or sell any of the securities herein named. We may or may not continue to hold any of the securities mentioned. White Brook Capital LLC and/or their respective officers, directors, partners or employees may from time to time acquire, hold or sell securities named in this report. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein