Before we get going, in tangential healthcare news - President Trump announced yesterday that the Coca Cola Company will start manufacturing sugar sweetened Coke for the US market after a conversation with the Company. This morning reports are that the Company feigned ignorance….We’ll probably get a single sugar-sweetened sku.

First it was the Gulf, now we’re taking Mexican-coke from Mexicans…. along with their naturalized immigration status, employment, and in many cases, freedom.

That got dark, let’s talk about this week’s healthcare stock performance.

—---

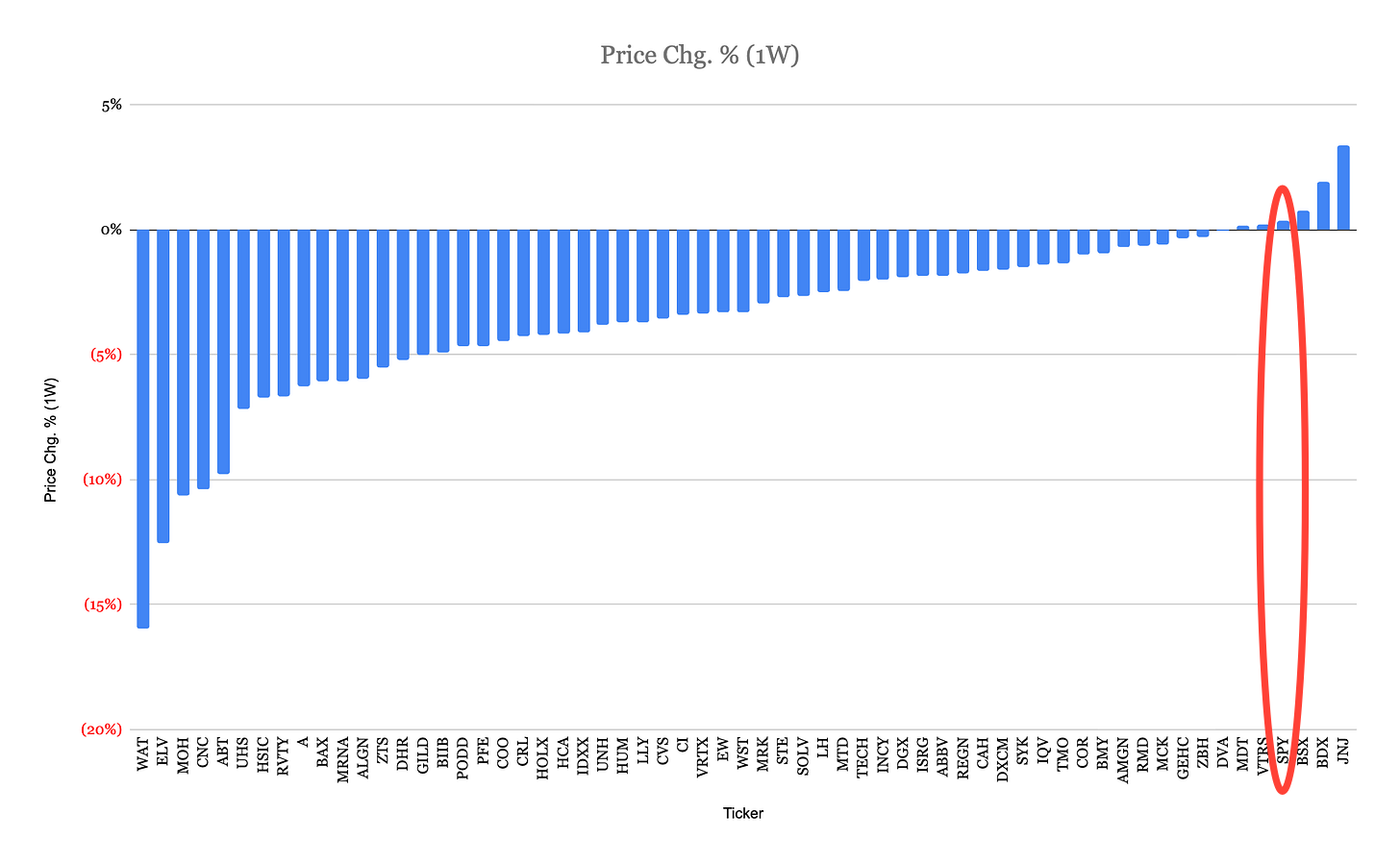

The week of July 12th (through July 17th) was a tough one for healthcare investors.

To be fair, some of the pain was self-inflicted.

United Healthcare the vertically integrated insurance, hospital and ambulatory surgery center operator, and physicians’ group is facing allegations of encouraging more complex (and thus more expensive) treatments when paid on a fee-for-service basis, while simultaneously characterizing complicated cases as uncomplicated when their payment schemes are capitated and they could lose money for higher utilization. This practice, bordering on fraud, casts a shadow on their future earnings power.

Similarly, Centene and Elevance Health, two prominent health insurance companies, demonstrated a critical flaw in their core skillset: risk assessment. They proved to be bad at it, leading to losses on capitated customers who have used healthcare services more intensively than modelled and priced. This issue is particularly concerning as it predates the impact of the One Big Beautiful Bill Act (OBBBA) that further reduces support for these companies’ activities via reductions in support for Medicare Advantage. While healthcare insurance reprices every year and therefore the losses from an individual “unprofitable” policy are short term, the bigger changes to these programs is likely to reduce the number of insured lives moving forward. The earnings power of these businesses in the future is likely different than the recent past.

Literally no one understands the economy, so let’s structure the conversation in terms of incentives and specific slivers of the industry. The payers are a harder investment proposition, moving forward. The hospitals are too.

The OBBBA undoes enough of the Affordable Care Act, that it will lead to more expensive Medicare Advantage policies and a greater un or underinsured population. The affected will lose access to less expensive healthcare and instead need to visit emergency rooms to treat ailments. This is expensive and hospitals will bear the cost. It’s difficult to see where the money will come from to treat those patients and not to eventually have to bail out the nation’s hospitals. The hospital lobby in 2023, argued that ~50% of hospitals were unprofitable, with a study claiming that as an industry hospitals have low single digit operating margins. This is not good.

Adding to hospital difficulties, the Center for Medicare and Medicaid Services (CMS) issued new guidance this week. They’ve removed some procedures from the inpatient only list (the most profitable part of the hospital), while also equalizing payments for procedures performed at hospital outpatient care facilities (historically higher, but lower than inpatient) with those in non-hospital outpatient care facilities. At face value, the goals of the policy are admirable - they seek to lower healthcare costs while also appealing to our sense of fairness. In reality, however, industry structure matters. Unlike 5 years ago, when this might have had an impact or 10 years ago when it could have changed healthcare, today, 77.6% of physicians are employees of hospitals/health systems and other corporate entities. The location of a procedure is not a fluid decision. It’s predetermined by the doctor, or more specifically, the doctor’s employer. For a non-hospital affiliated physician, the group has or is investing in their own facilities to capture the facility fee. Those procedures are already not taking place at a hospital. Hospital affiliated physicians, however, work at hospital owned facilities. They will continue to do so. The only thing that changes is how much the hospital will make, and if this doesn’t change before it's finalized, it will be less.

So hospitals will have worse economics moving forward as both increased uninsured patients using emergency rooms and reduced facility fees will eat into their margins.

For hospital vendors, the outlook is mixed. If their device was historically used in a hospital only, and was previously on the inpatient-only list, they now have more customers. New differentiated device manufacturers should also still have a customer as hospitals will be pressured to preserve procedure volume. Companies offering differentiated devices that can prove a positive return on investment through increased patient throughput or lower cost are likely to thrive. Commodity distributors, on the other hand, are likely to face stiff renegotiations as hospital administrators intensify their efforts to cut costs.

Whether any of this results in lower overall healthcare expenditures by the American populace remains an open question. On a micro level, however, there’s a lot of room for particular healthcare investments, particularly given the sour mood and the spoiling prices, that should do well, even with more restrictive government expenditures.