Information. Asymmetry. Profit.

Economically, the tide, if not going out, is much less strong than it once was. With most of the economy in a recession, bitcoin treasury companies, circular AI deals, widespread use of private credit - ideas built on a nugget of credibility - are starting to struggle. Before, there was always another fool, now there are at least temporarily, fewer.

The problem with big financial ideas is that they’re easily and routinely bastardized and exploited. Decentralized finance isn’t a bad concept, but when the idea was practicalized we ended up with cryptocurrencies that thus far have limited real world, legitimate use. Cheaper remittances are a solid outcome from privately run stablecoins, but drug deals, human and sex trafficking, and money laundering are the actual use cases of the currencies, heretofore. Its legitimate use is that of an unregulated trading vehicle, where companies that facilitate trading make money on the trading churn and real traders in the know can coordinate behavior to create runs. The virtue of the legitimized activity is the information asymmetry that it preys upon.

This term “information asymmetry” is one that I think we’ll hear more about in the coming year. It essentially means that an information release and dissemination advantage is created. High speed traders used to shorten the distance it took for electrons to travel to gain an advantage by colocating their servers with financial exchanges. Today, those advantages are being created and legitimized more nefariously in order to create a risk free bet.

This past month marked a pivotal moment for the online gambling industry. Over the last decade, gambling has shifted from a fringe, illegal activity—essentially an outgrowth of calling a bookie—to a mainstream, taxed, and legal pastime accessible on our phones. The legalization and mainstreaming of gambling has birthed ‘prediction markets.’ Like sports betting, these are time-limited, zero-sum propositions with binary payouts. November was significant for this sector, as the country’s largest financial exchanges—including the CME, CBOE, and the Intercontinental Exchange (owner of the NYSE)—formed partnerships to facilitate these markets.

Structurally, a bet in a prediction market is indistinguishable from a wager on FanDuel or DraftKings. On a coin flip for instance, you might buy a contract the outcome will be heads for $.50. After the event, your $.50 will go to someone who made that bet with you, or you will get someone else’s gambled $.50. It’s zero-sum with a binary payout. History shows that individual gamblers almost uniformly lose on these binary bets. If Warren Buffett’s first rule of investing is ‘don’t lose money,’ binary payouts make that virtually impossible, as being wrong means losing 100% of your capital.

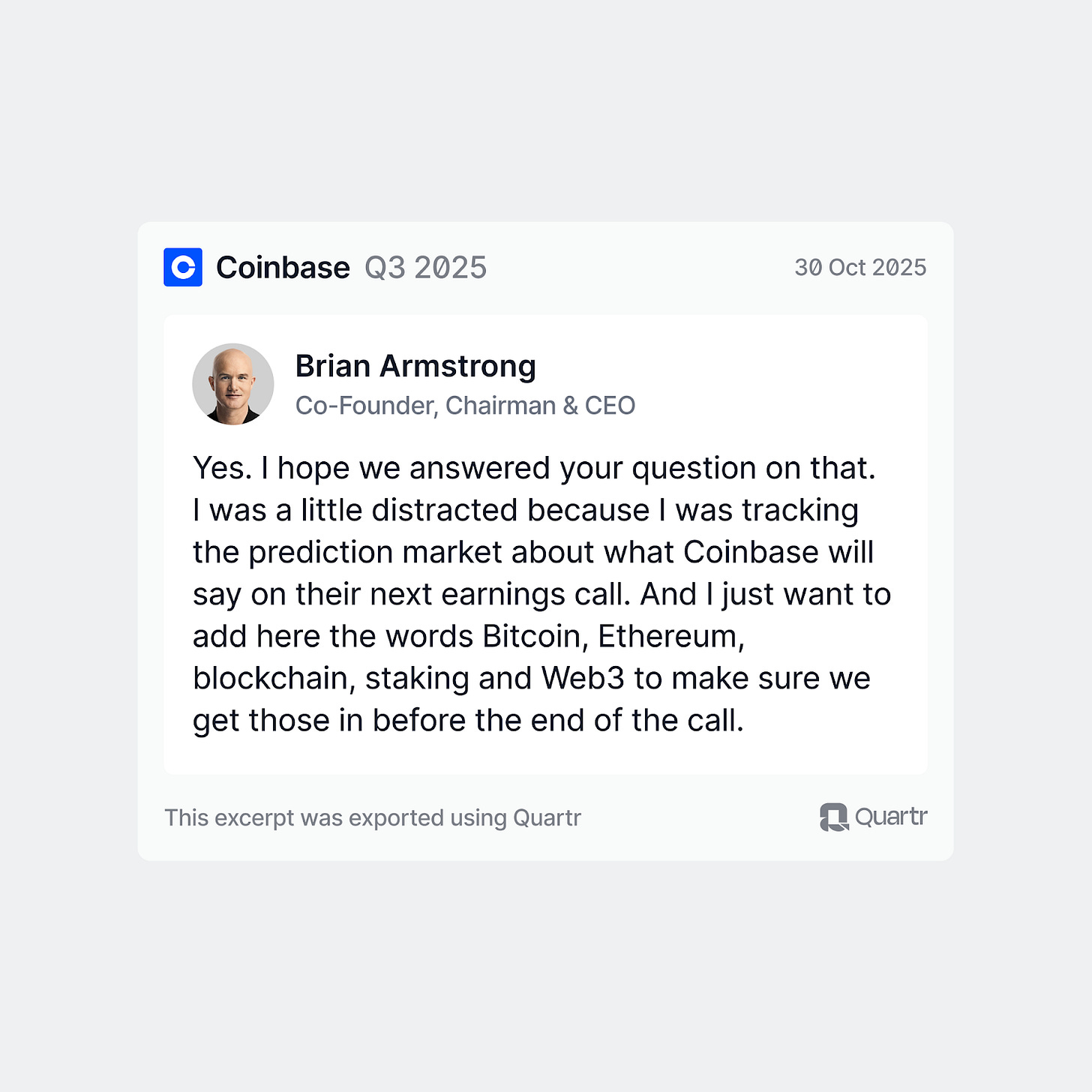

So it’s important to be right and that’s where the inability to regulate these markets plays a significant role. Last month, Brian Armstrong, CEO of Coinbase - a company that itself wants to tokenize and trade ownership in companies, thereby making regulation more difficult - on his earnings call, mentioned key words in order to make prediction market bets pay out.

There was no investigation as to why he did it. Who those bets may have helped. And whether Brian or his associates earned because of his actions. But you had an actor who could influence the outcome of the prediction market, influence the outcome of the market. To my mind, there’s little difference to a player intentionally missing a shot to not cover a spread or a boxer throwing a fight to collect on the gambling bounty. Brian had information the market did not - his willingness to say things - and he said them to influence the outcome. The ultimate in information asymmetry.

In yet another assault on fairness, the SEC is considering allowing companies to not report financials and hold conference calls for 6 months, versus the current quarterly cadence. People do exactly what you expect them to do, regardless of the pay level. Syndicating ownership in the capital markets shouldn’t mean that leadership can be any less responsible to owners if they were private. The dirty little secret is that at the point that a company could be public, private owners are as critical. Owners of small private retail companies review their accounts on a daily basis. Restaurants report their income to their owners in real time. Private equity owners review results from their portfolio companies at least weekly. Portfolio managers review performance daily. Everyone in a position where they can review their performance, does, even while acknowledging that it takes time for short, medium, and long term strategy to play out. The difference with being public is that you have to communicate audited financials - so the numbers have less room to mislead, and when a manager speaks, there are repercussions if they lie. Its a de minimis burden. Quarterly reporting doesn’t create ‘short-termism’ insomuch as it creates a longer period where they can fake it. Long-term strategy is bolstered by questions and considerations by interested stakeholders. Blinding owners to the performance of their own businesses is counterintuitive to how businesses are run under any other ownership structure. So there’s only one obvious benefit, it creates an informational advantage for insiders that allows them to sell or buy stock before the stock price reflects unannounced events.

In the 80s and 90s, before reg FD and in the early 2000s immediately following its passing, a key part of talking to management teams was trying to pull undisclosed financial information - creating an information assymetry. That part of the job has been mostly eliminated, and we’re all better for it. The recent trend towards recreating informational asymmetries is a bad one that requires attention from the investing public and from regulators to regulate these new platforms and create the conditions we’ve had for the past 20 years where fortunes can be created through thorough analysis and prudent risk taking. In a game defined by information asymmetry, if you don’t know who the mark is, it’s you.

Thanks for your time and have a happy Thanksgiving!

Basil