If it Moves it Breaks: The US Auto Industry

While many look towards autonomy to revolutionize the automobile industry, in White Brook’s view electrification will have started the process a decade or two earlier. The electric automobile replaces the internal combustion engine’s most used parts with parts that don’t move and therefore don’t break. Whether it’s a rotator belt, a piston, a hip, or a knee, a part that moves, breaks. That’s a real problem for a franchised dealership that relies on its parts and maintenance business to be profitable.

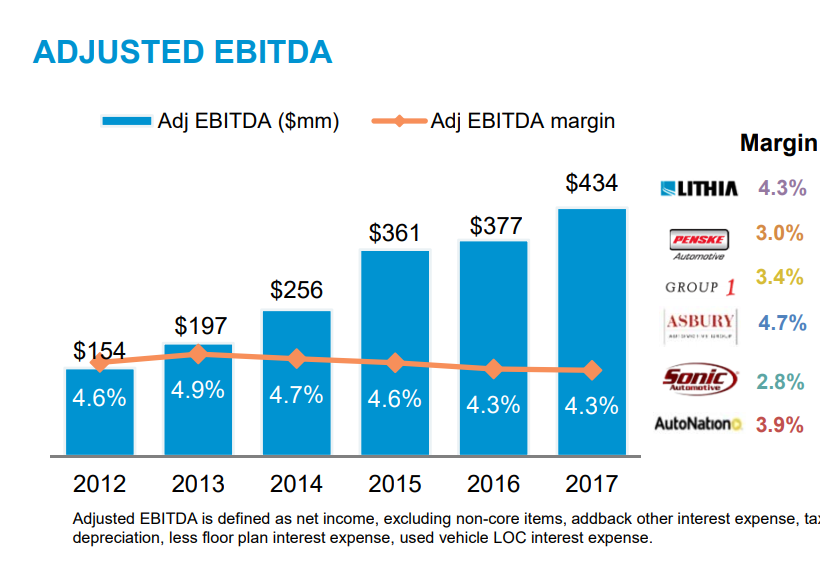

Exhibit: Automotive retailer financials

If parts and service profit dollars disappear, it’s hard to see a scenario where dealerships are economic investments. If dealerships aren’t economic investments, the distribution and pricing of electric cars are likely to be seriously impacted. After all, a car dealership should do what’s in its best interest and its best interest is to have a parts and services business. The incentives are not conducive to selling electric cars without a few changes, such as if:

Electric cars can be sold at a higher price relative to today’s cars

Electric cars can be sold at a greater margin than today’s cars (less money spent on the interior and niceties)

Electric cars can be sold in a different channel

The business model can be overhauled

Developing new distribution channels (the third option) is a very difficult, time consuming problem with the inherent conflict that is associated with fighting an incumbent that is also relied upon for a vast majority of current sales, not to mention the legal hurdles many states have that prevents direct selling. That leaves selling lower price/value cars through the same channel at higher prices or by putting in less value.

The second option is certainly available, and its likely that some manufacturers will target this market given the near universal consumer desire for electric cars regardless of income. It’s likely, however, that some portion of the mass market, and certainly the luxury mass market manufacturers will select the first option. As it is, cars are less affordable today than they’ve ever been and manufacturers have begun experimenting with automobiles as a service for consumers who care more about income than savings.

Exhibit: Automotive subscription services

This approach (the fourth option) seems likely to be the most successful.

It benefits from providing high margin revenue to the manufacturer.

Consumers accept the plans as they’ve become used to paying for consumer electronics similarly.

Manufacturers benefit from cars breaking down less, allowing them to recycle cars into the mid-market over time.

Dealers benefit in the short term by administrating the cars on behalf of the manufacturer, even while the value-add of the parts and service business and therefore their acceptable profit dollars decline.

Publicly, publicly traded managements push back on the idea of self-driving cars, while a quick review of recent company presentations reveals a couple dodges on the impact of electrification and no directly answered questions. But incentives determine the course of history and the mismatch between the consumers’ desires, the manufacturers’ needs, and the dealerships’ profits will determine how the inevitable, electric cars, actually make it to market. An economic model and go to market proposition that has been stagnant for a long time, backed by regulation that enforced the status quo, is likely to begin to be transformed.

As an aside, these developments may be a boon for independent dealerships who have their own role to play. The narrative promulgated by franchised dealers has been that they are in an increasingly stronger position as cars became more sophisticated and independent dealers have trouble servicing them. If cars don’t need to be maintained, however, maintaining a more sophisticated car isn’t that important. Customizing a car that is more expensive and lasts for longer so it can meet the needs of its driver, however, is likely to be more important. Reminiscent of the 80s and 90s when factory installed car audio was sub-standard and many consumers installed premium aftermarket audio systems, or the PC market where PCs today have long lifespans augmented by peripherals and accessories, the independent dealer may have a resurgent business.

Just things I’m thinking about….

Basil