Housing - Is the Thesis Broken?

Back in the 1940s, Isaac Asimov wrote books with side stories about things that we, as a society, are still trying to reach. It turns out, however, that the problem with developing technology, with developing anything for the future, is the financial feasibility of the efforts determines their success. We use nearly all of the technology developed during the internet boom of the early 2000s, but for the early investors it went bust.

One of White Brook’s theses is that the country is underhoused and we need to build more housing in order to rectify the problem. We have expressed that thesis by owning a residential building supply distribution company. While we bought stock in the 60s-80s and the stock is currently in the 130s, we only sold some of the position in the 200s, believing the stock still undervalued over the medium term. At least through the midpoint of 2024, we have been wrong.

Before answering whether there’s evidence that we’re underhoused, and trying to understand the likely path to rectify it, it’s important to think through the artifacts of the opposite - What would be true if supply and demand were balanced?

There are a couple of characteristics that are important to consider.

First, housing is a long lasting, durable good. That means that inventory that sits can retain its value if the carrying cost is low. Homes that do not have a mortgage have a carrying cost of a couple percent of their value per year. What we see today is that while new home listings are growing, inventory is sitting for longer, the prices being offered are higher and the homes that are transacted are at the same percentage above, below, or at asking as usual. If the market were in balance we would see prices flat to down. With treasury bonds at a healthy level for risk free investment today as well, there’s an opportunity cost to having capital tied up in a home that could be sold and the proceeds invested in the fixed income market. If the market were in balance, sellers should be motivated to sell, instead they appear to be waiting for the “right” price. This is evidence that the market is not in balance as an expectation exists that when interest rates fall, there will be incremental demand.

Second, demand is persistent, and is created by the formation of households. There are a number of ways to think about what drives household formation. About 2 million people graduate from college a year. About 2.3 million people get married every year. The U.S. net birth rate is +700k people per year, and our net immigration in 2023 was about 1.6mm people. The Federal Reserve has calculated household formation to be about a net 1-2mm per year and while there’s volatility in that number, it’s been relatively steady over time.

While the estimate may be threatened by backwards immigration policy, in the future, it’s more likely that immigration constituencies will shift rather than permanently dampen with any change in administration. As you can see during 2016-2019, household formation was solidly within the range.

Third, home inventory supply varies dramatically across geographies and seems to be driven by price as many continue to be rent constrained and unable to lower their housing cost. This again indicates that there’s an imbalance of housing supply as you would expect homes to more relatively freely between rent and ownership to be able to address the unmet need and earn excess rents.

The Path Forward

The path towards demand driving additional supply appears to be up to the path of interest rates. The cost to build homes today is higher than it was pre-pandemic due to an increase in labor’s cost and the cost to finance construction now that the cost of building materials has come back to pre-pandemic levels.

More materially, however, is the state of the consumer and the cost to finance a purchase. The consumer’s ability to pay for a home is driven by income, savings, and the cost of financing. Income growth has been healthy and in excess of inflation, but growth is slowing. Savings, which spiked for the average American during Covid, have now been worked down.

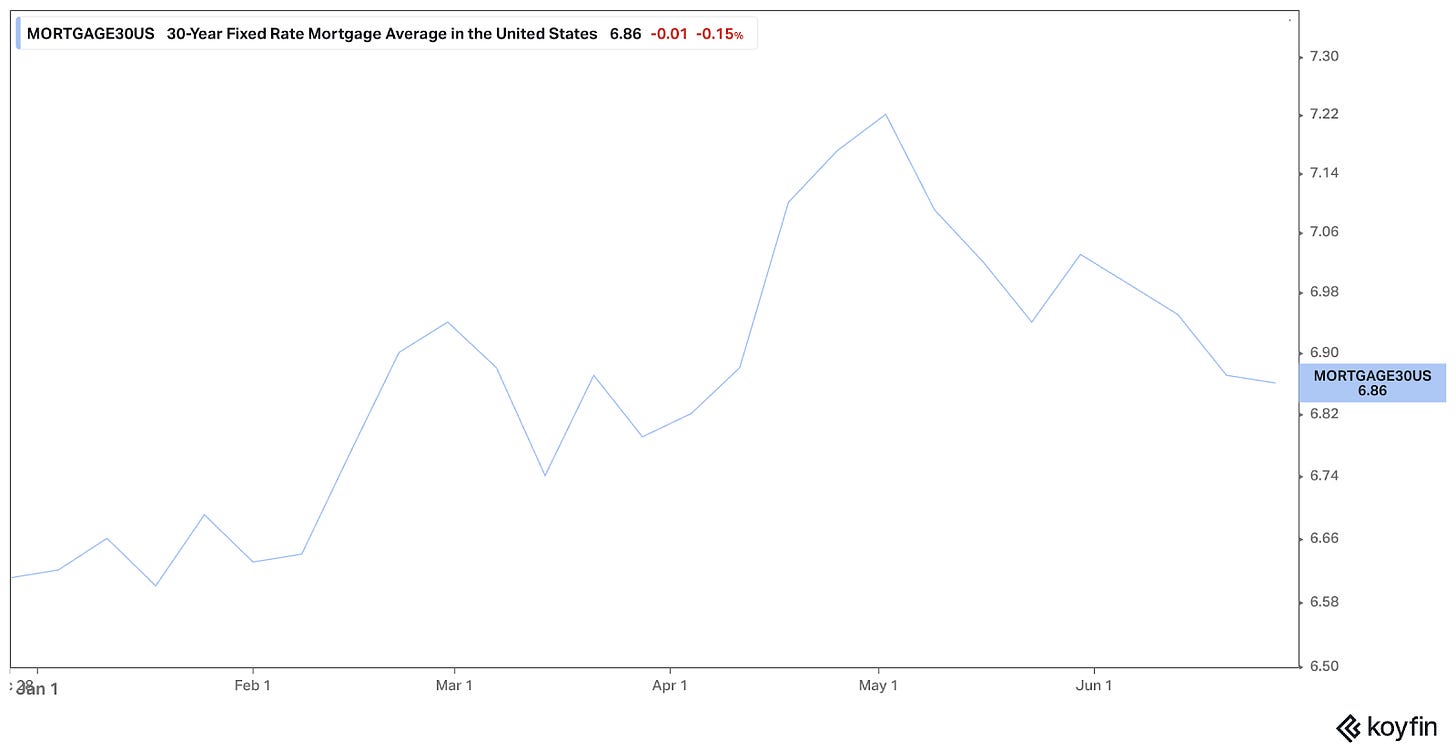

Which means the consumers' ability to pay is extremely sensitive to the cost to finance the purchase, mortgage rates. While interest rate expectations have reset higher, real estate professionals across the country noted that buyer interest “died” when mortgage rates increased above 7% as they did during the second quarter. National homebuilders, in June, noted that they believe the new home market is vibrant at an average mortgage rate of 6.75% on a fixed 30 year mortgage.

Freddie Mac estimates that we have 1.5mm fewer homes than needed to have a balanced housing market. They are at the low end, with some estimates as high as 5mm. Recurring deficits were created in the wake of the financial crises as the surplus created in its preamble resulted in a cessation of speculative home building activity and an annual deficit of building below household growth since. Interestingly, the debt today is as large as the surplus that was created by the building between 2001 and 2008.

This view, and White Brook’s view are not variant views.

To solve the housing crises and push down the cost of home ownership, the United States needs to build more homes in the right places. With ~1.4mm household units built a year and household formation of ~1.3-1.7mm a year, the country needs a sustained increase in homes built above 2023 levels in order to bring better balance to the market.

The second quarter of 2024 has been lost due to 7%+ mortgage rates, and it is likely that home building supply distribution companies will report lower earnings than expected in the very short term. Yet, it is also likely that now that 30 year mortgage interest rates are below 7%, there will be more construction permitting than the recent trend, and still more should rates decline more significantly.

I would also note that Brad Jacobs, one of the country’s most successful entrepreneurs, having built several multi billion dollar businesses, in multiple industries, recently raised capital to build a home building supply distributor through acquisition. The cash rich shell currently trades under the ticker QXO and was published about recently here. He has a $4.5 billion dollar war chest with the expressed purpose of building a technology-advantaged building supply distributor through acquisition - one a lot like Builders First Source (BLDR). He has historically found opportunity and built companies in underappreciated and sectors before, I think he found another one.

As always, feel free to reach out to discuss this or any thing else. I thank you for your support and will strive to continue to earn your trust.

Sincerely,

Basil F. Alsikafi

Portfolio Manager

White Brook Capital, LLC

Background and disclaimer: White Brook Capital has been long household formation and home construction for some time now. Builders First Source (BLDR) is our largest position. It is also our largest loss this year.

All investments involve risk, including loss of principal. This document provides information not intended to meet objectives or suitability requirements of any specific individual. This information is provided for educational or discussion purposes only and should not be considered investment advice or a solicitation to buy or sell securities. The information contained herein has been drawn from sources which we believe to be reliable; however, its accuracy or completeness is not guaranteed. This report is not to be construed as an offer, solicitation or recommendation to buy or sell any of the securities herein named. We may or may not continue to hold any of the securities mentioned. White Brook Capital LLC and/or their respective officers, directors, partners or employees may from time to time acquire, hold or sell securities named in this report. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein

a flood of capital will limit BLDR cap.allocation decisions. share BB, dividend increases more likely.

brad jacobs indicates his qxo funds will be used for tech+talent+rolodex, not for overpaying M&A. am skeptical; agnostic to whether this is 'smart money', brad says he moves on to something new each decade. neither brad nor bldr CEO have 'life or death' founder mindset.

some of brad's fanboys getting smoked...will new sheep flock?

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fcfeb3427-92b1-4b39-b56a-f028660af741_1182x456.png